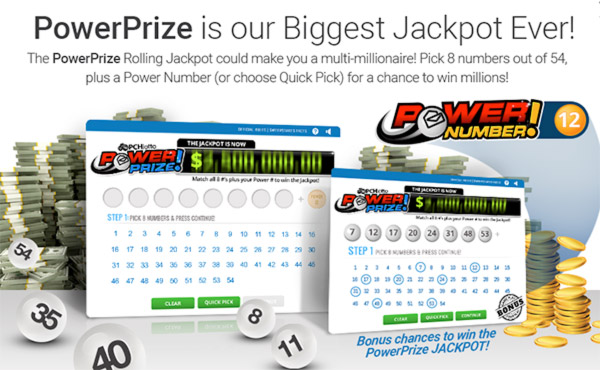

PCH Sweepstakes and Lotto – PCH Lotto Games Superprize (Giveaway No. *****) Life Is Rich. Bigger Buck$ Millions Rolling Jackpot Power Prize.You don’t have to buy anything to enter to PCH Play Lotto Games. The name says it all! A PowerPrize Jackpot from PCHLotto starting at $1,000,000 dollar and increasing up to $4,000,000 dollars Plus with a chance to win an additional lump-sum amount! Just Amazing! Takes advantage and Act Now by Responding to PCH Latest email offering PCH members to Opt-in in their new LOTTO AUTHORIZED ACTION PLAN To Make The Most Of Prize Opportunities Exclusively Available At PCHlotto. You will be in to win ALL of it with completion of your Lotto Action Plan by taking advantage of all the ways to win every day at PCH–lotto.

Giveaway – You could even see it grow, magnify, amplify at pchlotto.com / pick-winning-numbers. Enter For Free! As I write those words the new Lotto Authorized Action Plan to go for the maximum prizes available this week with a value of more than Multi Million Dollars – Amazing! You don’t have to buy anything to enter. PCH Lotto game.